free cash flow yield explained

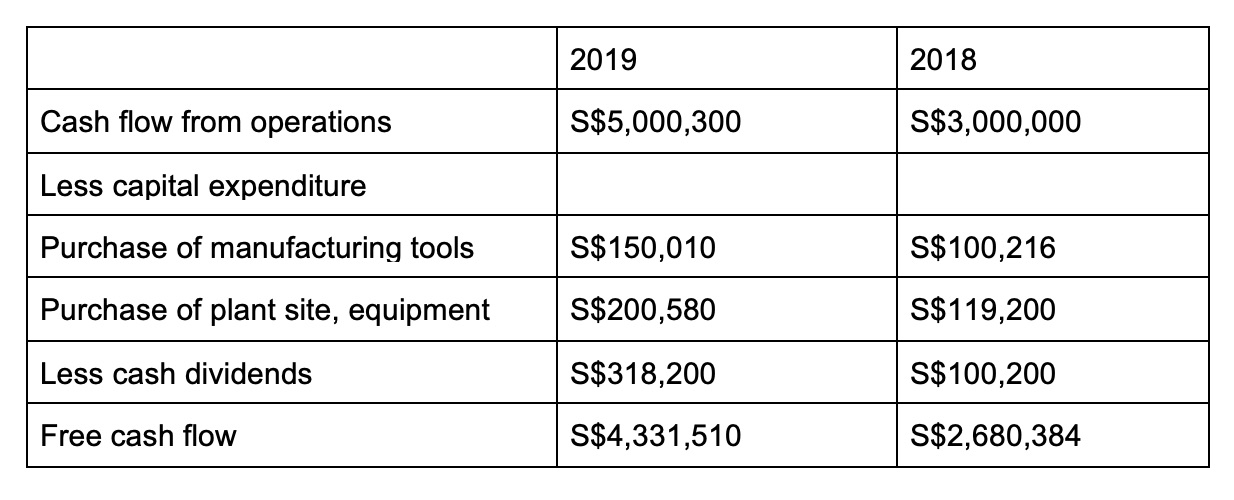

It shows the cash that a company can produce after deducting the purchase of assets such as property. Price to free cash flow is an equity valuation metric that indicates a companys ability to continue operating.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

The ratio is calculated by taking the free cash flow per share divided by the current share price.

. While all five scenarios have the same net profit of 15000. To break it down free cash flow yield is determined first by using a companys cash. The free cash flow yield FCFY is a financial solvency metric that compares a companys predicted free cash flow per share to its market value per share.

Httpsamznto35cbAn0Favorite Wealth Building Book. Free cash flow yield is widely quoted by analysts and gives investors a useful insight into whether a share is cheap or expensive. Going forward there is no way to be sure that free cash.

It is calculated by dividing its market capitalization by free cash flow. Net Operating Profit After Taxes Operating Income 1 - Tax Rate and. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share.

Terry Smith Book. What is Free Cash Flow FCF Free Cash Flow yield Stock market for beginnersIn this video on Free Cash Flow FCF we have talked about Definition o. Free cash flow yield free cash flowenterprise value offered the investor the highest return and the fewest periods of negative returns.

Remember the definition of cash yiel. In this weeks short video I explain how it works. Thatd give you an idea of what people are willing to pay to for a business that generates that cash.

Free cash flow FCF measures a companys financial performance. Free cash flow yield is a financial ratio that measures how much cash flow the company has in case of its liquidation or other obligations by comparing the free cash flow per. Free Cash Flow Yield Free Cash Flow Market Capitalization This ratio expresses the percentage of money left over for shareholders compared to the price of the stock.

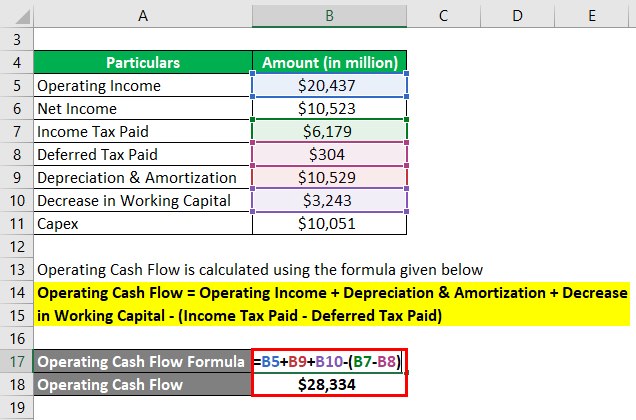

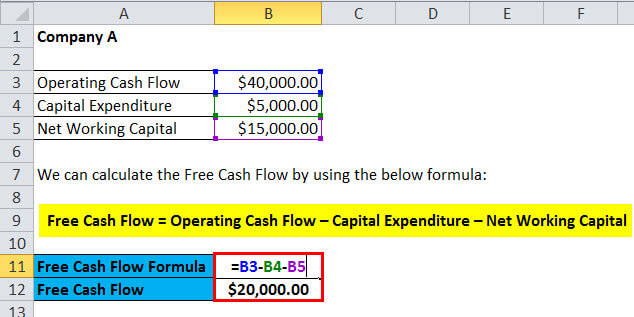

What Does Free Cash Flow Yield Mean. FCF is a useful valuation metric to determine a firms operating performance. Free Cash Flow Net Operating Profit After Taxes Net Investment in Operating Capital where.

Free cash flow yield is similar in nature to the earnings yield metric whic See more. What is the definition of free cash flow yield. Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures.

Thats the ratio of free cash flow to. Free cash flow yield is really just the companys free cash flow divided by its market value.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19316793/EGgJV_amazon_s_revenue_versus_profit_versus_free_cash_flow_.png)

Amazon S Profits Free Cash Flow And Revenue Explained Vox

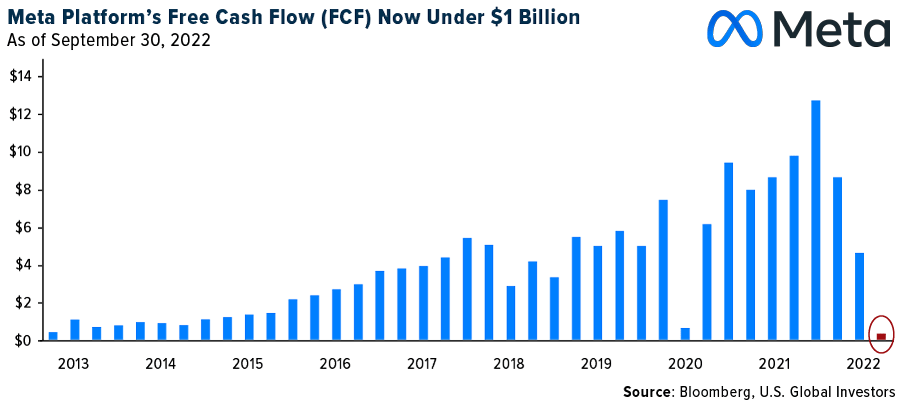

Meta Is Blowing Through Its Free Cash Flow Will The Metaverse Bet Pay Off Nasdaq Meta Seeking Alpha

Dcf Terminal Values Using The Right Exit Multiple The Footnotes Analyst

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Refreshing Revenue The Cash Conversion Cycle And Free Cash Flow Cfa Institute Enterprising Investor

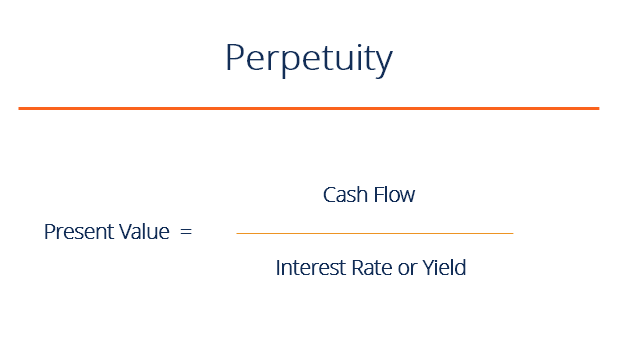

Perpetuity Definition Formula Examples And Guide To Perpetuities

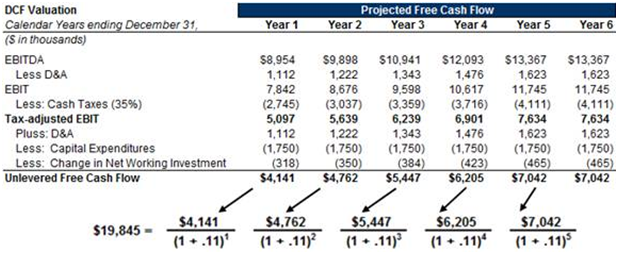

Discounted Cash Flow Analysis Street Of Walls

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Formula Calculator Excel Template

Free Cash Flow Yield Explained

Gutsy Analyst Argues That Already Expensive Stock Prices Will Get Even More Expensive

Free Cash Flow What This Metric Tells You About A Company S Financial Health Standard Chartered Singapore

How To Calculate Free Cash Flow Excel Examples

Free Cash Flow Meaning Examples Use In Valuation

Free Cash Flow Yield Formula And Calculation

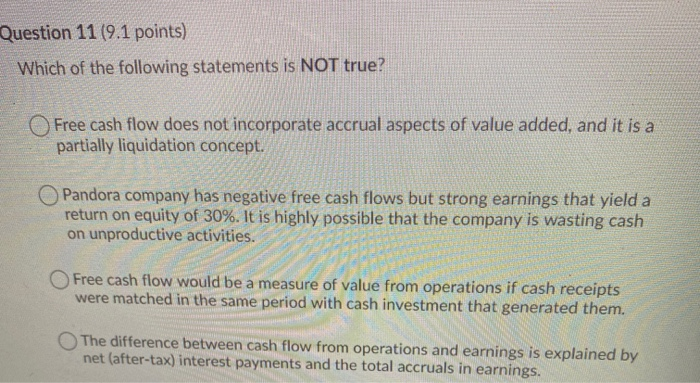

Solved Question 11 9 1 Points Which Of The Following Chegg Com